By Bob Young, Executive Managing Director, Weitzman

This past year has absolutely put to rest the false narrative that e-commerce and other challenges mean that retail real estate faces a “Retail Armageddon”.

Weitzman has reviewed the Texas retail markets for 35 years, and occupancy rates have never been higher.

In other words, after up-and-down cycles where we saw as much as 20 percent vacancy in some markets, we now see retail inventories that are ‘right-sized’ in terms of supply and demand.

Let’s look at the results of our recent retail market review for Texas’ four largest metros: Dallas-Fort Worth, Austin, Houston and San Antonio.

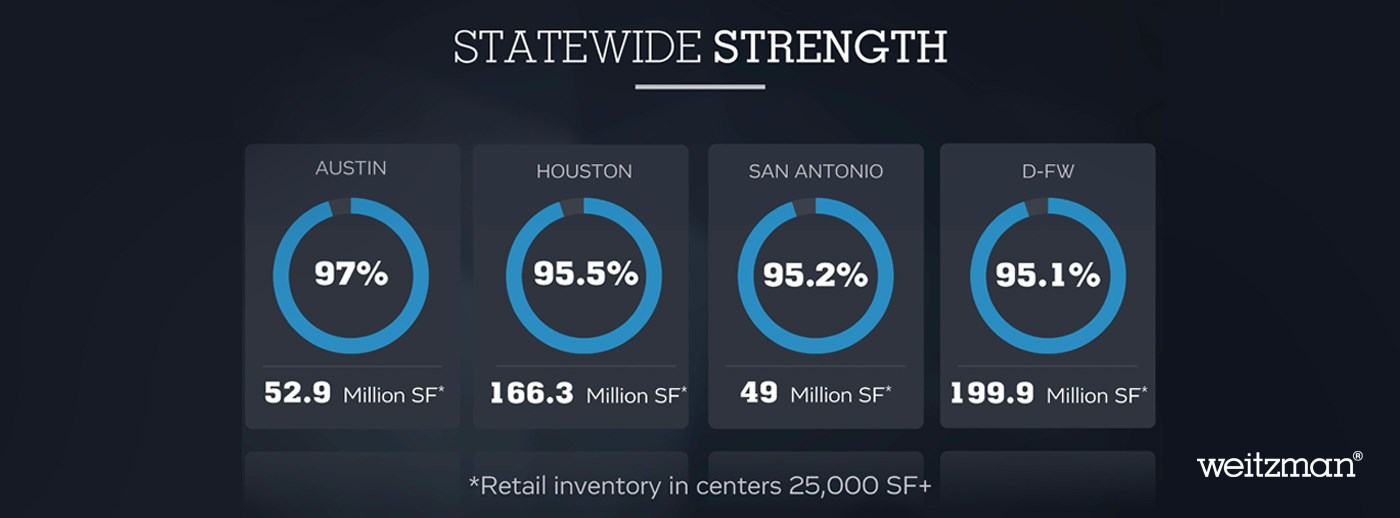

We review retail centers with 25,000 square feet or more, and D-FW reports the largest retail inventory in Texas with approximately 199.9 million square feet. That massive inventory is currently 95.1 percent occupied, tying the all-time record set in 2023.

In Austin, the metro area reports 52.9 million square feet, which is at 97 percent occupied. That’s the strongest occupancy among Texas’ major markets.

In Houston, the market reports 166.3 million square feet and an overall occupancy rate of 95.5 percent.

And San Antonio reports a 49-million-square-foot inventory that is 95.2 percent occupied.

These four massive retail markets continue to perform well even in the face of store closings from failed or struggling chains like Conn’s, Big Lots and Party City.

So we looked closely at the ‘why’ retail real estate is performing so well.

Without a doubt, one big reason is growth, particularly population growth. All four of our major metros are population magnets, and as we all know, retail follows rooftops.

That’s a big reason that grocery stores are the big construction drivers in these four markets.

In Austin, for example, the market saw two huge new H-E-B stores and a new Sprouts in 2024. This year will bring at least three new H-E-B stores, as well as stores from Sprouts, Desi Brothers and others.

In D-FW, grocery stores accounted for nearly half of the new retail deliveries of 1.5 million square feet in 2024. The new grocery store locations came from H-E-B, Tom Thumb and Kroger Marketplace.

This year will see the three already mentioned grocers add new locations, along with Walmart, Target, Costco, Whole Foods, Joe V’s Smart Shop and more. This grocery activity is a big reason D-FW is on track to add 2.7 million square feet of new retail this year – the highest level of new deliveries since 2018.

In Houston, the market’s 1.3 million square feet of new space included new stores from H-E-B, Costco and Joe V’s Smart Shop.

And in San Antonio, a new 104,000-square-foot H-E-B accounted for about a quarter of the market’s 423,000 square feet of new space.

As you can see, a significant percentage of our retail growth is due to Texas’ most active grocery store expansion market in years.

Statewide, the health of our retail market is in my opinion fully sustainable. The reason can be seen in these key factors.

First, Retail construction remains conservative.

Our four major metro markets are in the midst of a years-long streak of balanced and healthy retail real estate, and new deliveries still remain in check.

• Second, most of the new space is in anchor stores for grocers and other big box users.

More and more grocers have now staked their futures in Texas because our growth warrants it.

They’ve taken down development sites that mean we’ll see grocery activity for years to come!

• And third, Brick-and-mortar retail is more essential and more innovative than ever, thanks to ‘tech and mortar’.’

Tech & Mortar is Weitzman’s term for Physical retail real estate that is supercharged with Digital outreach.

•Brick-and-mortar also creates what ICSC calls the ‘halo’ effect.

Physical stores create essential ‘brand billboards’ that enhance brand awareness and trust. And that gives the customer the confidence to shop the brand both in-store and online.